Targeted science, Tailored solutions for people with autoimmune disease 2025 J.P. Morgan Healthcare Conference January 14, 2025 Exhibit 99.1

Forward-looking statements 2 This presentation contains forward-looking statements for the purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995 and other federal securities laws. The use of words such as "can," “may,” “might,” “will,” “would,” “should,” “expect,” “believe,” “estimate,” “design,” “plan,” "intend," "anticipate," and other similar expressions are intended to identify forward-looking statements. Such forward looking statements include Immunovant’s expectations regarding patient enrollment, timing, design, and results of clinical trials of its product candidates and indication selections; Immunovant's plan to develop IMVT-1402 and batoclimab across a broad range of autoimmune indications; expectations with respect to these planned clinical trials including the number and timing of (a) trials Immunovant expects to initiate, (b) FDA clearance with respect to IND applications, and (c) potential pivotal or registrational programs and clinical trials of IMVT-1402; the size and growth of the potential markets for Immunovant's product candidates and indication selections, including any estimated market opportunities; Immunovant’s plan to explore in subsequent study periods follow-on treatment with alternative dosing regimens; Immunovant's beliefs regarding the potential benefits of IMVT- 1402's and batoclimab's unique product attributes and first-in-class or best-in-class potential, as applicable; Immunovant’s anticipated strategic reprioritization from batoclimab to IMVT-1402; and whether, if approved, IMVT-1402 or batcolimab will be successfully distributed, marketed or commercialized. All forward-looking statements are based on estimates and assumptions by Immunovant’s management that, although Immunovant believes to be reasonable, are inherently uncertain. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that Immunovant expected. Such risks and uncertainties include, among others: initial results or other preliminary analyses or results of early clinical trials may not be predictive of final trial results or of the results of later clinical trials; results of animal studies may not be predictive of results in humans; the timing and availability of data from clinical trials; the timing of discussions with regulatory agencies, as well as regulatory submissions and potential approvals; the continued development of Immunovant’s product candidates, including the timing of the commencement of additional clinical trials; Immunovant’s scientific approach, clinical trial design, indication selection, and general development progress; future clinical trials may not confirm any safety, potency, or other product characteristics described or assumed in this presentation; any product candidate that Immunovant develops may not progress through clinical development or receive required regulatory approvals within expected timelines or at all; Immunovant’s product candidates may not be beneficial to patients, or even if approved by regulatory authorities, successfully commercialized; the effect of global factors such as geopolitical tensions and adverse macroeconomic conditions on Immunovant’s business operations and supply chains, including its clinical development plans and timelines; Immunovant’s business is heavily dependent on the successful development, regulatory approval and commercialization of batoclimab and IMVT-1402; Immunovant is in various stages of clinical development for IMVT-1402 and batoclimab; and Immunovant will require additional capital to fund its operations and advance IMVT-1402 and batoclimab through clinical development. These and other risks and uncertainties are more fully described in Immunovant’s periodic and other reports filed with the Securities and Exchange Commission (SEC), including in the section titled “Risk Factors” in Immunovant’s most recent Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 7, 2024, and Immunovant’s subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Immunovant undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. and IMMUNOVANT® are registered trademarks of Immunovant Sciences GmbH. All other trademarks, trade names, service marks, and copyrights appearing in this presentation are the property of their respective owners. Dates used in this presentation refer to the applicable calendar year unless otherwise noted.

Our Company

Our vision: Normal lives for people with autoimmune disease 4 Love Trailblazing All Voices Bolder, Faster What we do: We are developing targeted therapies that are designed to address the complex and variable needs of people with autoimmune diseases.

Graves' POC observed greater benefit with deeper IgG reduction 5 INDs cleared for lead asset, IMVT-1402 Initiated IMVT-1402 pivotal trials in Graves' Disease & ACPA+ D2T RA1 Unprecedented speed of starting pivotal trials with autoinjector2 2024: Many milestones achieved supporting lead asset IMVT-1402 MG trial completed enrollment with batoclimab Meaningfully strengthened balance sheet 1. Difficult-to-Treat Rheumatoid Arthritis 2. Based on review of publicly available information of 16 recently approved or clinical stage immunology programs; additional details in subsequent slide 5

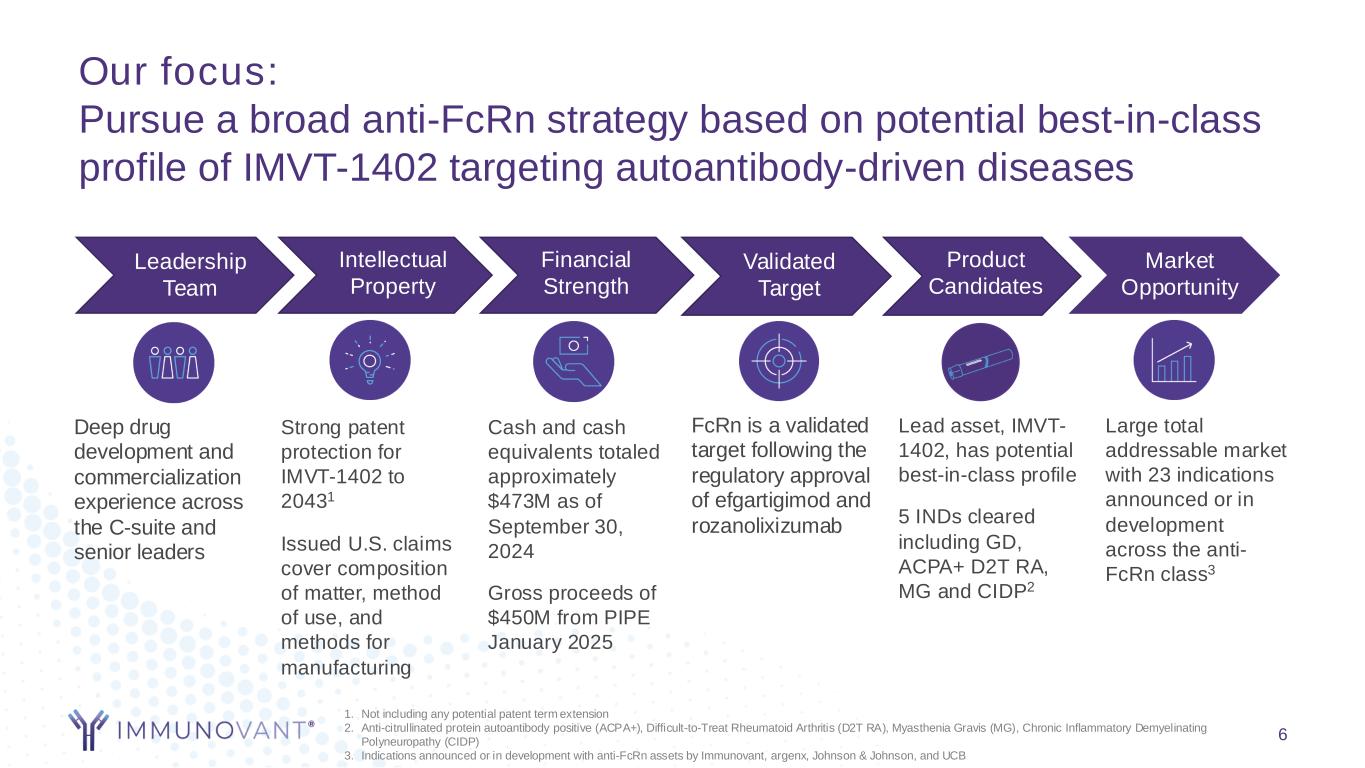

Our focus: Pursue a broad anti-FcRn strategy based on potential best-in-class profile of IMVT-1402 targeting autoantibody-driven diseases 6 Leadership Team Intellectual Property Financial Strength Validated Target Product Candidates Market Opportunity Deep drug development and commercialization experience across the C-suite and senior leaders Cash and cash equivalents totaled approximately $473M as of September 30, 2024 Gross proceeds of $450M from PIPE January 2025 FcRn is a validated target following the regulatory approval of efgartigimod and rozanolixizumab Lead asset, IMVT- 1402, has potential best-in-class profile 5 INDs cleared including GD, ACPA+ D2T RA, MG and CIDP2 Large total addressable market with 23 indications announced or in development across the anti- FcRn class3 Strong patent protection for IMVT-1402 to 20431 Issued U.S. claims cover composition of matter, method of use, and methods for manufacturing 1. Not including any potential patent term extension 2. Anti-citrullinated protein autoantibody positive (ACPA+), Difficult-to-Treat Rheumatoid Arthritis (D2T RA), Myasthenia Gravis (MG), Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) 3. Indications announced or in development with anti-FcRn assets by Immunovant, argenx, Johnson & Johnson, and UCB

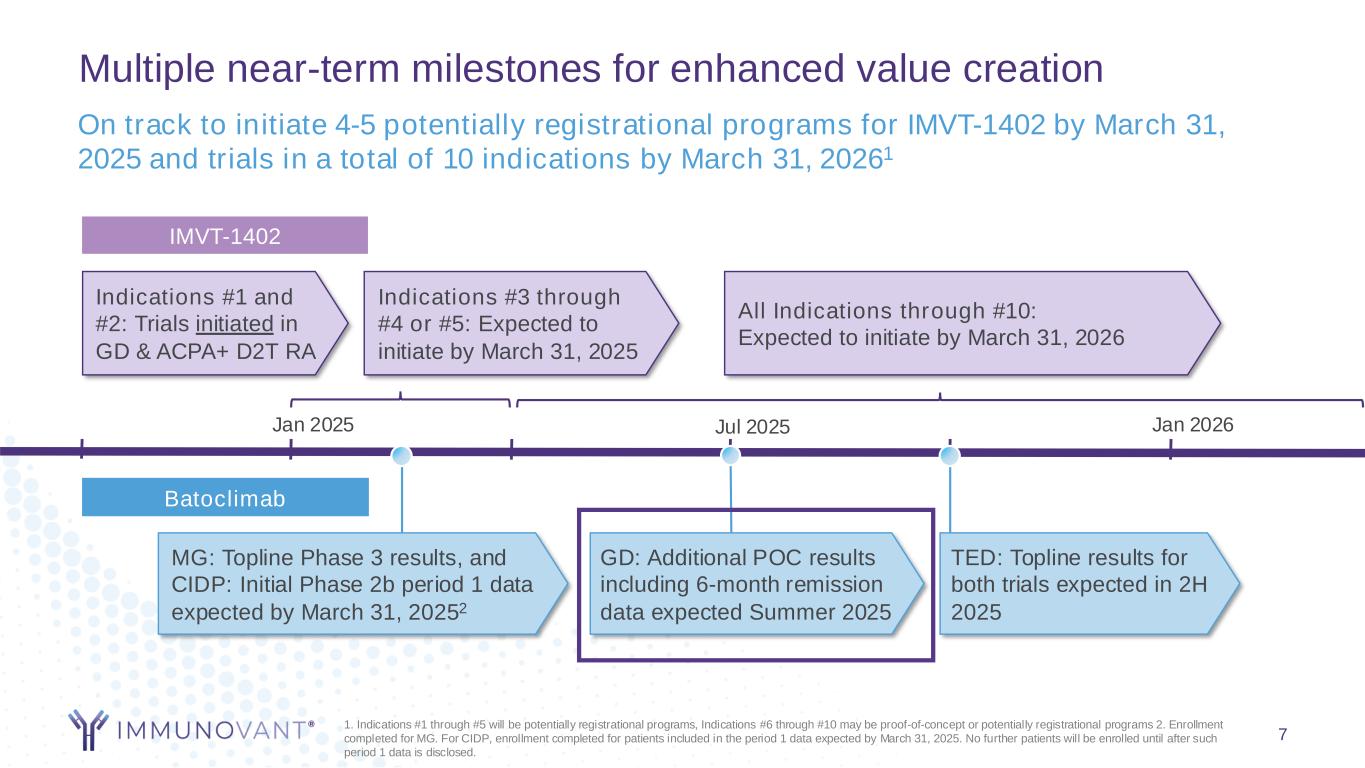

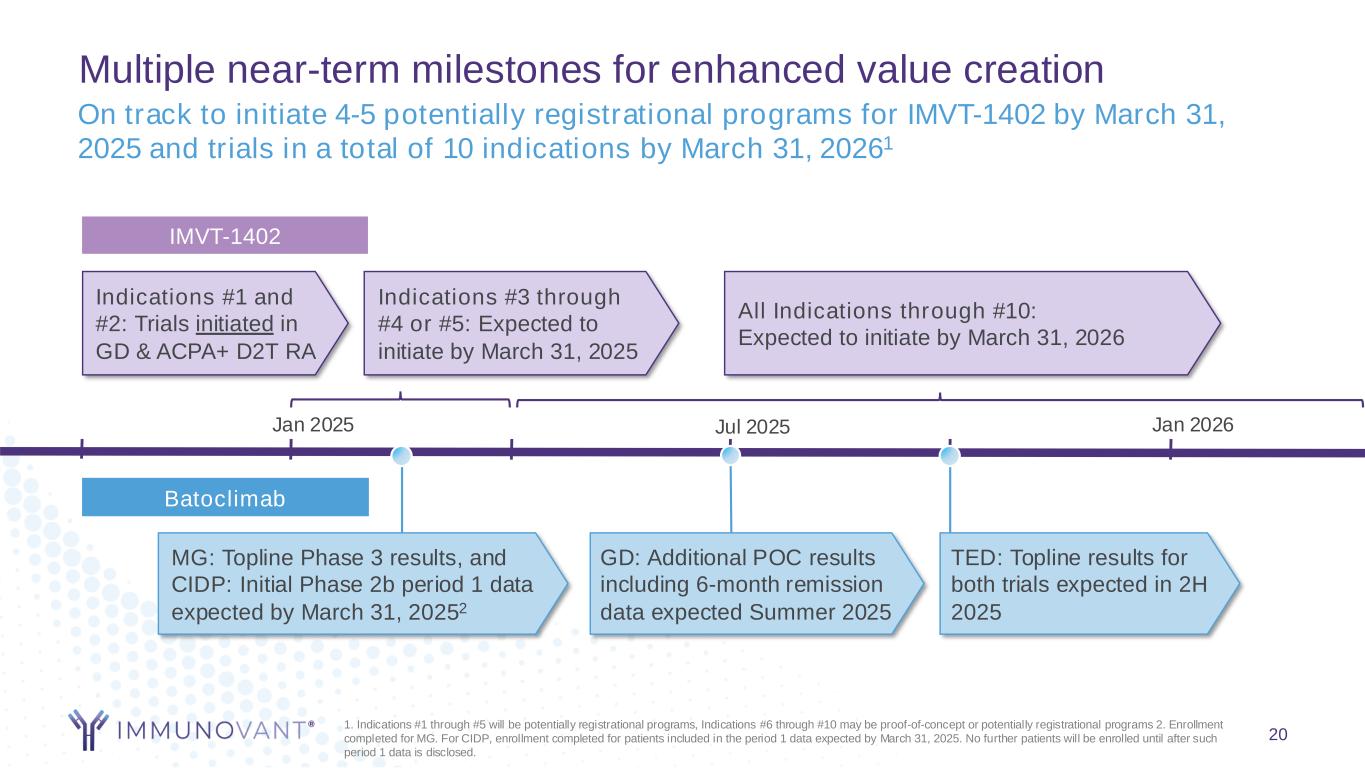

Multiple near-term milestones for enhanced value creation Jan 2025 TED: Topline results for both trials expected in 2H 2025 MG: Topline Phase 3 results, and CIDP: Initial Phase 2b period 1 data expected by March 31, 20252 1. Indications #1 through #5 will be potentially registrational programs, Indications #6 through #10 may be proof-of-concept or potentially registrational programs 2. Enrollment completed for MG. For CIDP, enrollment completed for patients included in the period 1 data expected by March 31, 2025. No further patients will be enrolled until after such period 1 data is disclosed. All Indications through #10: Expected to initiate by March 31, 2026 On track to initiate 4-5 potentially registrational programs for IMVT-1402 by March 31, 2025 and trials in a total of 10 indications by March 31, 20261 GD: Additional POC results including 6-month remission data expected Summer 2025 Jul 2025 7 Jan 2026 IMVT-1402 Batoclimab Indications #3 through #4 or #5: Expected to initiate by March 31, 2025 Indications #1 and #2: Trials initiated in GD & ACPA+ D2T RA

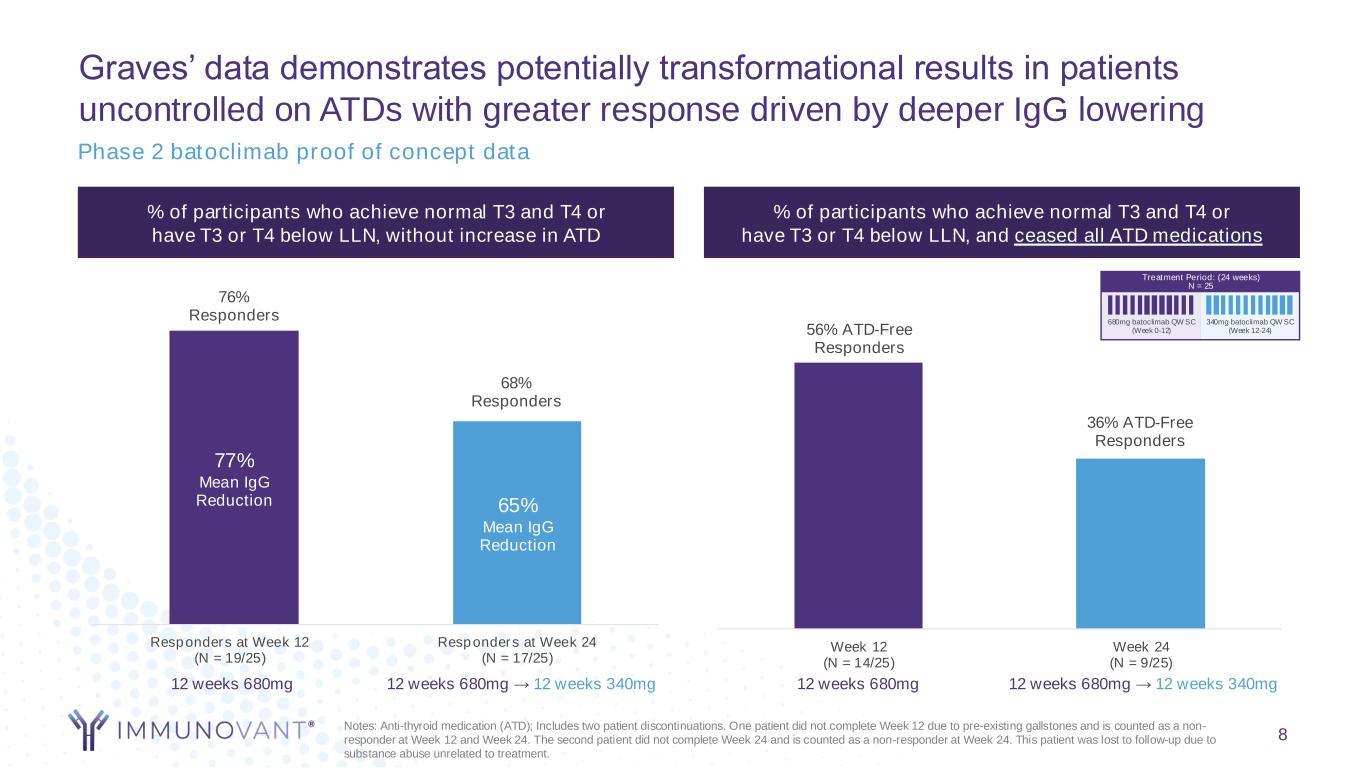

8 % of participants who achieve normal T3 and T4 or have T3 or T4 below LLN, without increase in ATD % of participants who achieve normal T3 and T4 or have T3 or T4 below LLN, and ceased all ATD medications 76% Responders 68% Responders Responders at Week 12 (N = 19/25) Responders at Week 24 (N = 17/25) 12 weeks 680mg → 12 weeks 340mg12 weeks 680mg 77% Mean IgG Reduction 65% Mean IgG Reduction 56% ATD-Free Responders 36% ATD-Free Responders Week 12 (N = 14/25) Week 24 (N = 9/25) 12 weeks 680mg 12 weeks 680mg → 12 weeks 340mg Treatment Period: (24 weeks) N = 25 340mg batoclimab QW SC (Week 12-24) 680mg batoclimab QW SC (Week 0-12) Notes: Anti-thyroid medication (ATD); Includes two patient discontinuations. One patient did not complete Week 12 due to pre-existing gallstones and is counted as a non- responder at Week 12 and Week 24. The second patient did not complete Week 24 and is counted as a non-responder at Week 24. This patient was lost to follow-up due to substance abuse unrelated to treatment. Graves’ data demonstrates potentially transformational results in patients uncontrolled on ATDs with greater response driven by deeper IgG lowering Phase 2 batoclimab proof of concept data

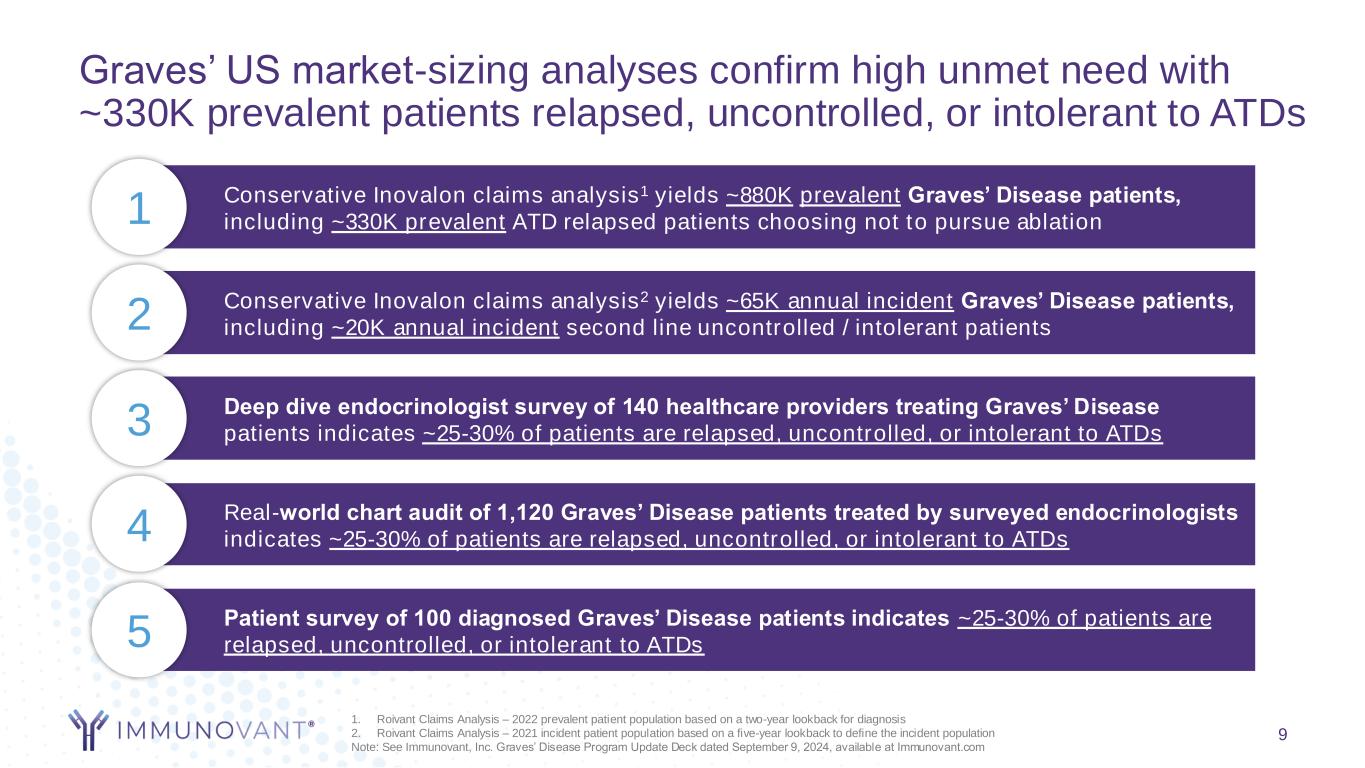

9 Conservative Inovalon claims analysis1 yields ~880K prevalent Graves’ Disease patients, including ~330K prevalent ATD relapsed patients choosing not to pursue ablation 1 Real-world chart audit of 1,120 Graves’ Disease patients treated by surveyed endocrinologists indicates ~25-30% of patients are relapsed, uncontrolled, or intolerant to ATDs4 Patient survey of 100 diagnosed Graves’ Disease patients indicates ~25-30% of patients are relapsed, uncontrolled, or intolerant to ATDs5 Deep dive endocrinologist survey of 140 healthcare providers treating Graves’ Disease patients indicates ~25-30% of patients are relapsed, uncontrolled, or intolerant to ATDs3 Conservative Inovalon claims analysis2 yields ~65K annual incident Graves’ Disease patients, including ~20K annual incident second line uncontrolled / intolerant patients2 Graves’ US market-sizing analyses confirm high unmet need with ~330K prevalent patients relapsed, uncontrolled, or intolerant to ATDs 1. Roivant Claims Analysis – 2022 prevalent patient population based on a two-year lookback for diagnosis 2. Roivant Claims Analysis – 2021 incident patient population based on a five-year lookback to define the incident population Note: See Immunovant, Inc. Graves’ Disease Program Update Deck dated September 9, 2024, available at Immunovant.com

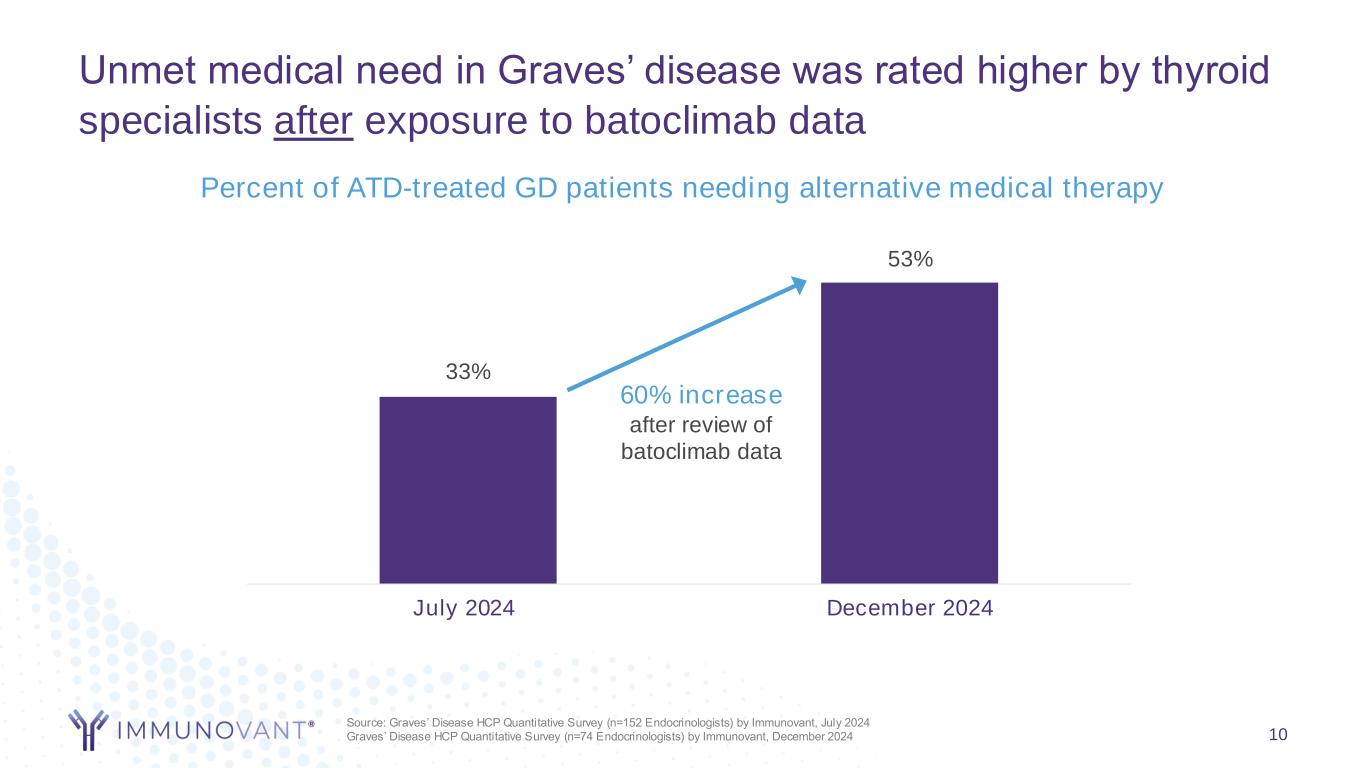

Unmet medical need in Graves’ disease was rated higher by thyroid specialists after exposure to batoclimab data 10 Percent of ATD-treated GD patients needing alternative medical therapy Source: Graves’ Disease HCP Quantitative Survey (n=152 Endocrinologists) by Immunovant, July 2024 Graves’ Disease HCP Quantitative Survey (n=74 Endocrinologists) by Immunovant, December 2024 33% 53% July 2024 December 2024 60% increase after review of batoclimab data

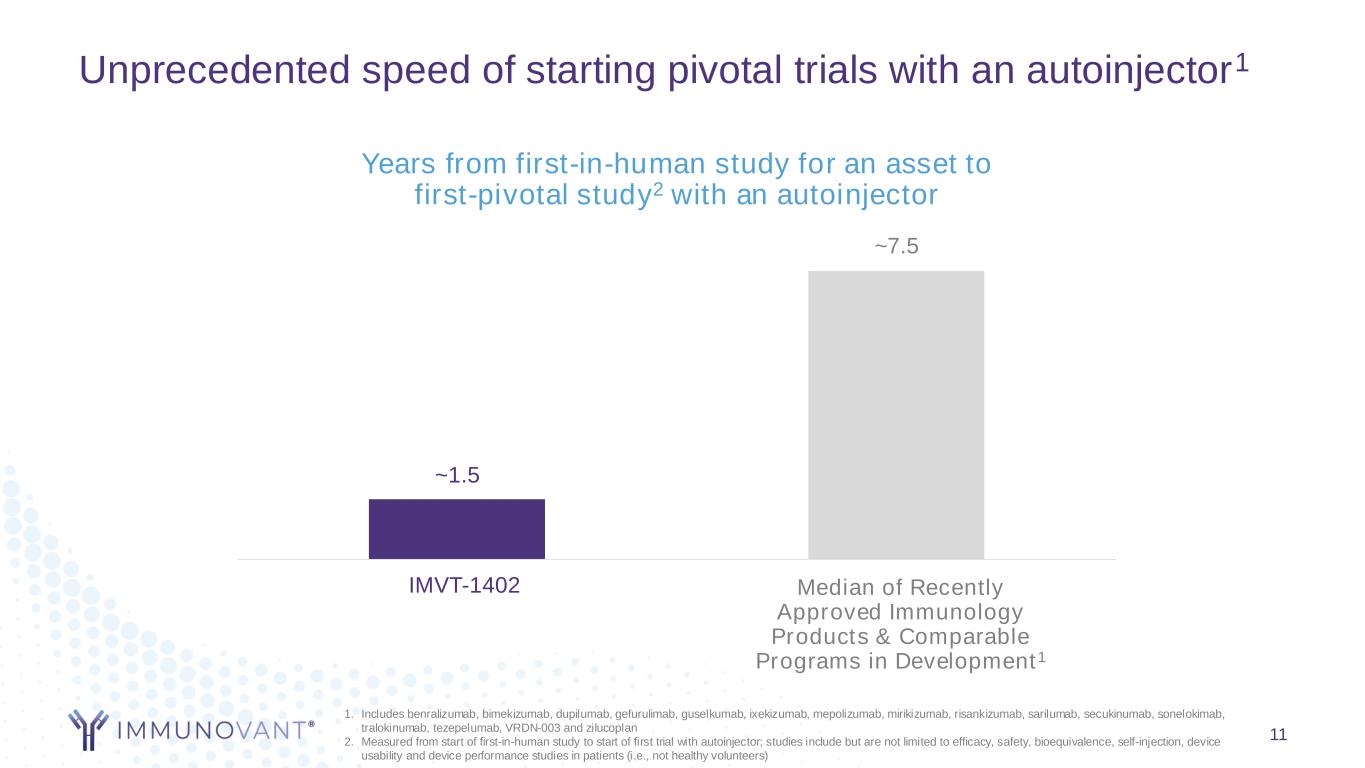

Unprecedented speed of starting pivotal trials with an autoinjector1 11 ~1.5 ~7.5 Immunovant Precedent Immunology Products Years from first-in-human study for an asset to first-pivotal study2 with an autoinjector Median of Recently Approved Immunology Products & Comparable Programs in Development1 IMVT-1402 1. Includes benralizumab, bimekizumab, dupilumab, gefurulimab, guselkumab, ixekizumab, mepolizumab, mirikizumab, risankizumab, sarilumab, secukinumab, sonelokimab, tralokinumab, tezepelumab, VRDN-003 and zilucoplan 2. Measured from start of first-in-human study to start of first trial with autoinjector; studies include but are not limited to efficacy, safety, bioequivalence, self-injection, device usability and device performance studies in patients (i.e., not healthy volunteers)

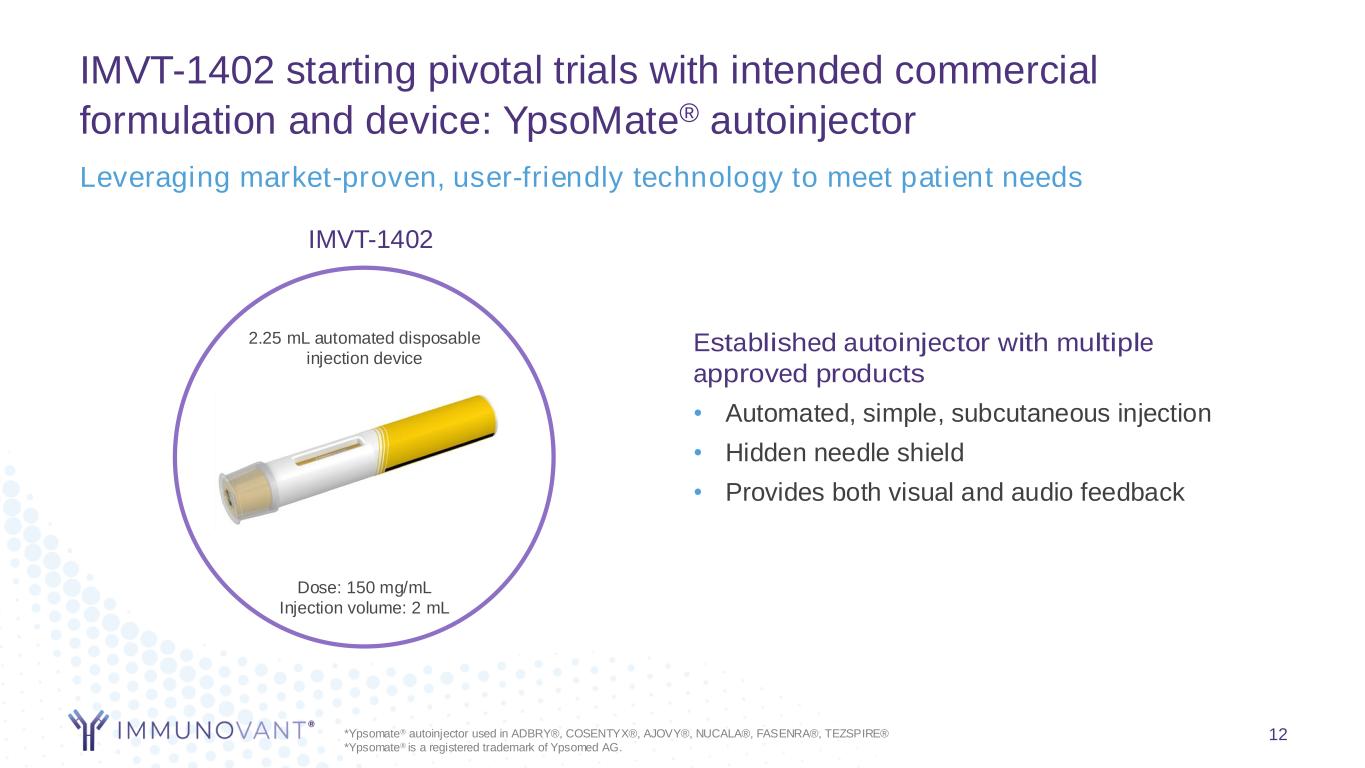

IMVT-1402 starting pivotal trials with intended commercial formulation and device: YpsoMate® autoinjector 12 Leveraging market-proven, user-friendly technology to meet patient needs Established autoinjector with multiple approved products • Automated, simple, subcutaneous injection • Hidden needle shield • Provides both visual and audio feedback Dose: 150 mg/mL Injection volume: 2 mL IMVT-1402 2.25 mL automated disposable injection device *Ypsomate® autoinjector used in ADBRY®, COSENTYX®, AJOVY®, NUCALA®, FASENRA®, TEZSPIRE® *Ypsomate® is a registered trademark of Ypsomed AG.

Our Market

2024: Many positive developments for the FcRn inhibitor class Positive data in new indications1 Approval in new indication2 Mixed results from other modalities3 Growing KOL enthusiasm for earlier line anti- FcRn use Ever-growing conviction in anti-FcRn as a uniquely exciting class 14 1. https://us.argenx.com/news/2024/argenx-advances-clinical-development-efgartigimod-primary-sjogrens-disease; https://www.janssen.com/late-breaking-results-show- nipocalimab-significantly-improves-sjogrens-disease-activity-phase-2 2. Vvygart Hytrulo approval for CIDP; https://www.fda.gov/drugs/news-events-human-drugs/fda-approves-treatment-chronic-inflammatory-demyelinating-polyneuropathy-cidp- adults 3. https://www.chugai-pharm.co.jp/english/news/detail/20240321150000_1059.html

Our Differentiation

16 Tailored dosing To help alleviate symptoms across disease stage and severity Rapid & deep IgG reduction Strong correlation between deep IgG reduction and increased clinical efficacy Our differentiated value proposition: Three potentially unique attributes to address unmet patient needs Subcutaneous injection To enable self-administration at home

Favorable Analyte Profile Phase 1 data supports a favorable analyte profile with no or minimal effect on albumin and LDL 1. Not including any potential patent term extension 17 Our lead asset: IMVT-1402 has a combination of potentially best-in-class attributes not seen with other anti-FcRns Novel, fully human, monoclonal antibody inhibiting FcRn-mediated recycling of IgG + IMVT-1402 ++ + + + Convenient Administration Delivered via market-proven, user-friendly autoinjector Compelling Patent Protection Issued U.S. patent covers composition of matter, method of use and methods for manufacturing to 20431 Deep IgG Lowering Phase 1 data suggests deep dose- dependent IgG lowering

An exciting 2025

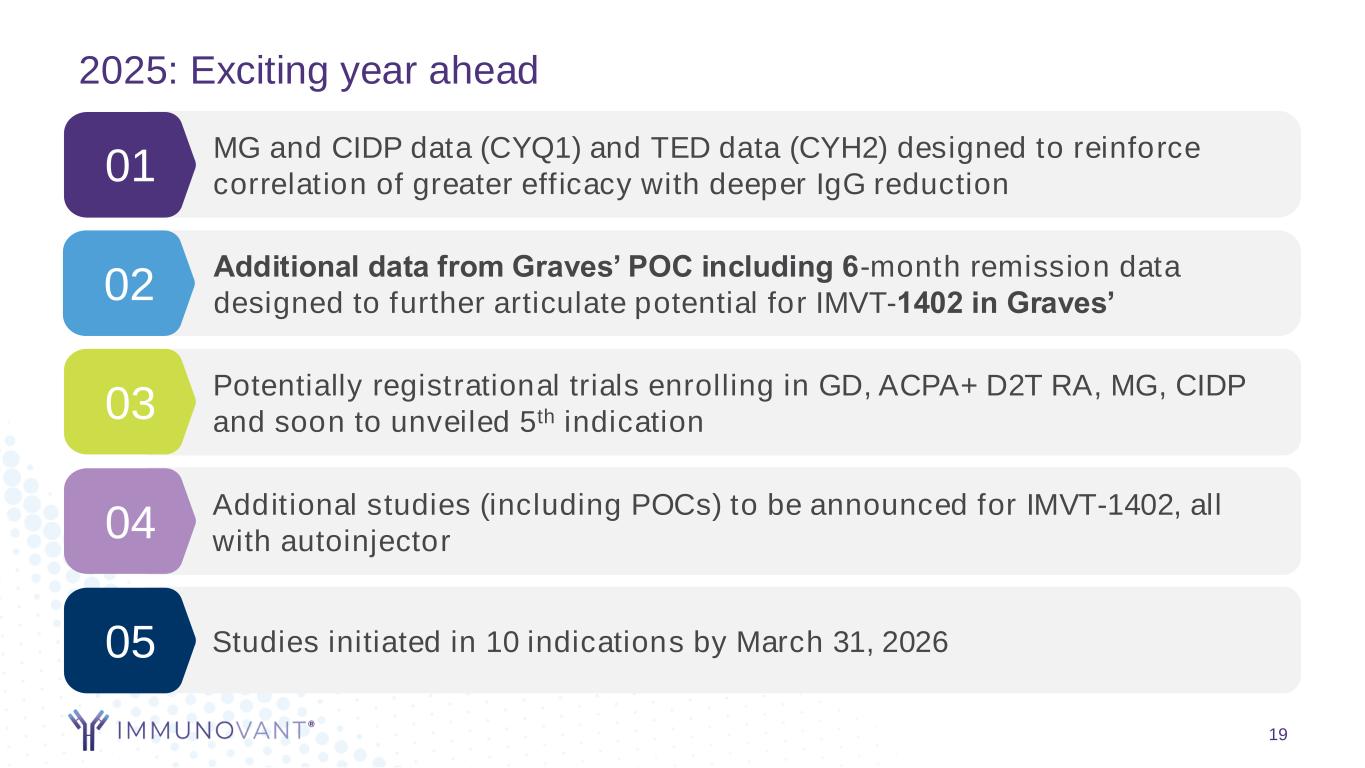

2025: Exciting year ahead 19 MG and CIDP data (CYQ1) and TED data (CYH2) designed to reinforce correlation of greater efficacy with deeper IgG reduction01 Additional data from Graves’ POC including 6-month remission data designed to further articulate potential for IMVT-1402 in Graves’02 Potentially registrational trials enrolling in GD, ACPA+ D2T RA, MG, CIDP and soon to unveiled 5th indication03 Additional studies (including POCs) to be announced for IMVT-1402, all with autoinjector04 Studies initiated in 10 indications by March 31, 202605

Multiple near-term milestones for enhanced value creation Jan 2025 TED: Topline results for both trials expected in 2H 2025 MG: Topline Phase 3 results, and CIDP: Initial Phase 2b period 1 data expected by March 31, 20252 1. Indications #1 through #5 will be potentially registrational programs, Indications #6 through #10 may be proof-of-concept or potentially registrational programs 2. Enrollment completed for MG. For CIDP, enrollment completed for patients included in the period 1 data expected by March 31, 2025. No further patients will be enrolled until after such period 1 data is disclosed. All Indications through #10: Expected to initiate by March 31, 2026 Indications #3 through #4 or #5: Expected to initiate by March 31, 2025 On track to initiate 4-5 potentially registrational programs for IMVT-1402 by March 31, 2025 and trials in a total of 10 indications by March 31, 20261 GD: Additional POC results including 6-month remission data expected Summer 2025 Jul 2025 20 Indications #1 and #2: Trials initiated in GD & ACPA+ D2T RA Jan 2026 IMVT-1402 Batoclimab

Thank you